The development of the concept of return-on-investment from large-scale quality improvement programmes in healthcare: an integrative systematic literature review

For example, if net income for the year is $10,000, and total average assets for the company over the same time period is equal to $100,000, then the ROA is $10,000 divided by $100,000, or 10%. The term yield is often used in connection to return, which refers to the income component in relation to some price for the asset. The total return of an asset for the holding period relates to all the cash flows received by an investor during any designated time period to the amount of money invested in the asset. Various changes occur in a society like economic, political and social systems that have influence on the performance of companies and thereby on their expected returns. Hence the impact of these changes is system-wide and the portion of total variability in returns caused by such across the board factors is referred to as systematic risk. These risks are further subdivided into interest rate risk, market risk, and purchasing power risk.

- In general, return ratios compare the tools available to generate profit, such as the investment in assets or equity to net income.

- Where the individual sub-periods are each equal (say, 1 year), and there is reinvestment of returns, the annualized cumulative return is the geometric average rate of return.

- A return of +100%, followed by −100%, has an average return of 0% but an overall return of −100% since the final value is 0.

- Return on assets (ROA) is a profitability ratio calculated as net income divided by average total assets that measures how much net profit is generated for each dollar invested in assets.

- In most cases, risk means the possibility you’ll lose some or even all of the money you invest.

In general, higher investment returns can only be generated by taking on higher investment risk. For example, by diversifying a portfolio of investment assets, a comparable return can often be generated with less risk than an undiversified investment portfolio. That being said, there is a limit to the effectiveness of diversification as a portfolio grows increasingly large. For example, stock and stock mutual funds tend to change price more quickly than most fixed-income investments, such as bonds. If you buy a stock just before its price jumps, the total return will be stronger than if you bought after the price stabilized or before it began to drop.

Phrases Containing return

Examples of such factors are raw material scarcity, labour strike, management inefficiency, etc. When the variability in returns occurs due to such firm-specific factors it is known as unsystematic risk. This risk is unique or peculiar to a specific organization and affects it in addition to the systematic risk. Various components cause the variability in expected returns, which are known as elements of risk. There are broadly two groups of elements classified as systematic risk and unsystematic risk. Investors should also consider whether the risk involved with a certain investment is something they can tolerate given the real rate of return.

Bits & Bites: Le Diner En Blanc returns, as does Vegan Restaurant … – Baltimore Sun

Bits & Bites: Le Diner En Blanc returns, as does Vegan Restaurant ….

Posted: Wed, 09 Aug 2023 09:01:24 GMT [source]

The term refers to the loss or gain on an investment over a set period. We can apply it to any type of investment, from mutual funds to stocks to bonds. There are many different types of investments and asset classes, such as money market securities, bonds, public equities, private equity, private debt, and real estate, to name but a few. All of these asset classes come with varying levels of investment risk.

Yield vs. Return

Having investments with different risk-return profiles helps meet the different risk appetites of various investor groups. A return (also referred to as a financial return or investment return) is usually presented as a percentage relative to the original investment over a given time period. But if you can wait out downturns in the market, chances are that the value of a diversified portfolio will rebound, and you’ll end up with a gain. If you look at the big picture, you’ll discover that what seems to be a huge drop in price over the short term evens out over the long term. In fact, over periods of 15 or 20 years or more, stocks as a group — usually the most volatile investments over the short term — have always increased in value.

- For example, a startup business could become bankrupt, or it could become a multimillion-dollar company.

- If you want the financial security and sense of accomplishment that comes with investing successfully, you have to be willing to take some risk.

- The capital appreciations of the investments are nothing but the

capital gains of the investments i.e. the difference in between the closing and

opening price of the investments.

Mutual funds report total returns assuming reinvestment of dividend and capital gain distributions. That is, the dollar amounts distributed are used to purchase additional shares of the funds as of the reinvestment/ex-dividend date. Reinvestment rates or factors are based on total distributions (dividends plus capital gains) during each period. It may be measured either in absolute terms (e.g., dollars) or as a percentage of the amount invested. In the 1990s, many different fund companies were advertising various total returns—some cumulative, some averaged, some with or without deduction of sales loads or commissions, etc.

What Are Returns in Investing, and How Are They Measured?

It refers

to variability of returns due to fluctuations in the securities market which is

more particularly to equities market due to the effect from the wars,

depressions etc. This statistical figure measures the dispersion of a dataset relative to its mean, calculated as the square root of the variance. There’s no way around the fact that most investments will drop in value at some point.

The third principle is that you can balance risk and return in your overall portfolio by making investments along the spectrum of risk, from the most to the least. Diversifying your portfolio in this way means that some of your investments have the potential to provide strong returns while others ensure that part of your principal is secure. A positive return is the profit, or money made, on an investment or venture.

Real Return

Return on investment may be extended to terms other than financial gain. It can be used by any entity to evaluate the impact on stakeholders, identify ways to improve performance and enhance the performance of investments. Asset class #5 is private equity, which involves investments in private companies that are not publicly traded on an exchange. These investments are typically riskier than public equities and include additional risks such as liquidity risk. However, because of these additional risks, private equity also offers investors the highest potential investment returns. When it comes to investing, risk and return come hand-in-hand – you cannot have one without the other.

Return, on the other hand, encompasses both the income generated by an investment and any capital gains or losses that result from changes in the investment’s market price. Return ratios make this comparison by dividing selected or total assets or equity into net income. For instance, return of capital (ROC) means the recovery of the original investment. A nominal concept of return return is the net profit or loss of an investment expressed in the amount of dollars (or other applicable currency) before any adjustments for taxes, fees, dividends, inflation, or any other influence on the amount. It can be calculated by figuring the change in the value of the investment over a stated time period plus any distributions minus any outlays.

Over the course of a day, a month, or a year, the price of your investments may fluctuate, sometimes dramatically. This constant movement, known as volatility, varies from investment to investment, with some investments being significantly more volatile than others. Taking risk doesn’t mean you have to take flying leaps into untested waters — it means anticipating what the potential problems with a certain investment might be and putting a strategy in place to manage, or offset them.

It is common practice to quote an annualized rate of return for borrowing or lending money for periods shorter than a year, such as overnight interbank rates. Return is

the combination of both the regular income and capital appreciation of the

investments.The regular income is nothing but dividend/interest income of the

investments. The capital appreciations of the investments are nothing but the

capital gains of the investments i.e. the difference in between the closing and

opening price of the investments. What complicates the picture is that inflation reduces the buying power of your investment return, as well as your investment income. If the inflation rate is 3% in a year that your investment provides a 6% return, your real return, or return after correcting for inflation, is 3%.

That increases the likelihood that you’ll want to avoid the risk of losing principal even if you make yourself more vulnerable to inflation risk. For instance, there’s risk in concentrating all of your savings in just one or two stocks or bonds. There’s investment risk in choosing to put your money into one company rather than another. And there’s management risk that a company’s officers may make serious errors. These are examples of what’s known as nonsystemic risk because the potential problem lies in the individual investment, not the investment marketplace.

Rate of return

To generate higher expected returns, investors usually need to take on more risk of potential losses. With that out of the way, here is how basic earnings and gains/losses work on a mutual fund. The fund records income for dividends and interest earned which typically increases the value of the mutual fund shares, while expenses set aside have an offsetting impact to share value. When the fund’s investments increase (decrease) in market value, so too the fund shares value increases (or decreases). When the fund sells investments at a profit, it turns or reclassifies that paper profit or unrealized gain into an actual or realized gain. The sale has no effect on the value of fund shares but it has reclassified a component of its value from one bucket to another on the fund books—which will have future impact to investors.

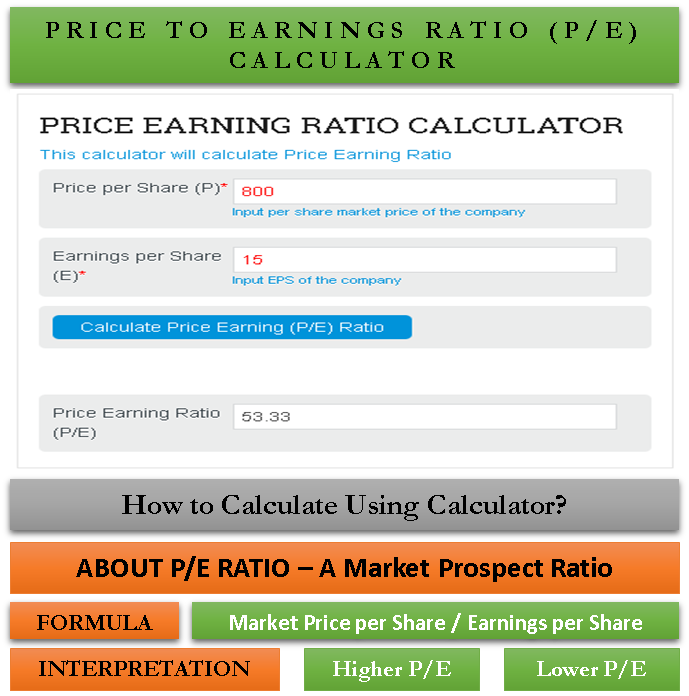

For example, the return on assets ratio is calculated by dividing the income from the new assets by the newly invested assets. This shows the income or return from the assets as a percentage of the assets. Yield, in the context of fixed income, for example, is the income generated by an investment, usually expressed as a percentage of the investment’s price or face value. For instance, a bond with a face value of $1,000 and an annual coupon (interest payment) of $50 would have a yield of 5%.

Seattle Opera launches 60th anniversary season with return to Wagner – The Seattle Times

Seattle Opera launches 60th anniversary season with return to Wagner.

Posted: Tue, 08 Aug 2023 13:00:00 GMT [source]

Indeed, the math shows that proper diversification can reduce a portfolio’s volatility while maintaining or potentially increasing its expected return. The total return for a stock includes both capital gains and losses and dividend income, while the nominal return for a stock depicts only its price change. Return on investment (ROI) or return on costs (ROC) is a ratio between net income (over a period) and investment (costs resulting from an investment of some resources at a point in time). A high ROI means the investment’s gains compare favourably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several different investments.[1] In economic terms, it is one way of relating profits to capital invested. Investments carry varying amounts of risk that the investor will lose some or all of the invested capital.

Lascia un commento Annulla risposta

Categorie

- ! Без рубрики (62)

- 1 (46)

- 10000_ru (6)

- 11275_ru (3)

- 1Win AZ Casino (1)

- 1win Azerbajany (5)

- 1Win Brasil (2)

- 1win Brazil (1)

- 1WIN Casino Brasil (1)

- 1WIN Official In Russia (2)

- 1win Turkiye (3)

- 1win uzbekistan (2)

- 1xbet apk (12)

- 1xbet Argentina (4)

- 1xbet AZ Casino (2)

- 1xbet Azerbajan (3)

- 1xbet Brazil (3)

- 1xbet CASINO AZ (2)

- 1xbet Casino Online (2)

- 1xbet giriş (3)

- 1xbet Online Casino (2)

- 1xbet qeydiyyat (6)

- 2 (11)

- 212 (1)

- 7900_ru (5)

- 9185_ru (6)

- 9200_ru (11)

- 9200_ru2 (6)

- 9400_ru (6)

- 9460_ru (6)

- 9560_ru (6)

- 9750_ru (6)

- AI News (9)

- article (3)

- articles (1)

- Artifical Intelligence (1)

- Artificial Intelligence (1)

- Artificial intelligence (AI) (2)

- AZ Most BET (1)

- Azerbajany Mostbet (3)

- b1bet apostas (3)

- Bahisyasal (7)

- Bahsegel (3)

- Best Nationality Man To Datehttps://3.bp.blogspot.com/-kBknlnppsDo/VogAaAUQObI/AAAAAAAAGIQ/GwgzMkHTbi4/s400/beautiful-bbw-13_mini.jpg|loving someone long distance (1)

- Betmotion brazil (1)

- Bettilt (2)

- Bettilt giris (2)

- bh50 bahis forum (2)

- bht2 (2)

- Blog (4)

- bonanza dec (3)

- Bookkeeping (66)

- Bootcamp de programação (2)

- Bootcamp de Programación (2)

- bt50 flaming hot slot (3)

- btt2 (2)

- Casino (27)

- casino en ligne fr (1)

- casino onlina ca (2)

- Casino Online (2)

- casino online ar (3)

- casinò online it (2)

- Casino Slots (2)

- casinomaxisites oyna (3)

- casinos (2)

- Codere AR (3)

- codere mexico (3)

- Crypto Bot (1)

- Crypto-PBN (3)

- Cryptocurrency exchange (4)

- Cryptocurrency News (6)

- Cryptocurrency service (4)

- Dating A Foreigner (1)

- Dating Someone From A Different Country (2)

- done 15381 (1)

- Education (5)

- Fall In Love With Someone You Don't Share A Common Language (1)

- FinTech (29)

- Forex ENG (1)

- Forex Trading (17)

- fxdu.net (1)

- g (1)

- Gambling (8)

- Gaming (1)

- Generative AI (2)

- Hitbet (1)

- How Can I Date A Girl From A Different Country (1)

- How To Date Someone Internationally (1)

- India Mostbet (4)

- IT Education (5)

- IT Vacancies (3)

- IT Вакансії (5)

- IT Образование (14)

- Kasyno Online (13)

- Kasyno Online PL (1)

- king johnnie (2)

- legit mail order brides (1)

- leovegas finland (3)

- LeoVegas India (7)

- LeoVegas Sweden (6)

- Lucky Green casino (1)

- Marriage Certificate Requirements (1)

- marsbahis (1)

- MaxiMarkets (1)

- Most Romantic Honeymoon Destinations (1)

- mostbet apk (22)

- Mostbet AZ (3)

- mostbet az 90 (19)

- Mostbet AZ Casino (3)

- mostbet azerbaijan (5)

- Mostbet Casino Azerbaycan (1)

- Mostbet Casino UZ Online (1)

- mostbet giriş (9)

- Mostbet India (4)

- mostbet kirish (1)

- mostbet oyna (2)

- mostbet ozbekistonda (2)

- mostbet royxatga olish (1)

- Mostbet Russia (1)

- mostbet tr (1)

- mostbet UZ (11)

- Mostbet UZ Casino (2)

- Mostbet UZ Casino Online (1)

- Mostbet UZ Kirish (1)

- Mostbet Uzbekistan (3)

- mostbet-ru-serg (8)

- New folder (2) (1)

- New Post (1)

- News (252)

- Online Betting (1)

- Online casino (2)

- online casino au (2)

- Online Dating Europe (1)

- Online games (2)

- onwin dec (1)

- onwin oyna (1)

- Padişahbet (1)

- pagbet brazil (1)

- Paribahis (3)

- pb50 roll oyna (2)

- pbt2 (4)

- Pin UP AZ Casino (1)

- Pin UP AZ Online (1)

- Pin Up Brazil (2)

- pin up casino (3)

- Pin UP Casino AZ (3)

- Pin UP Online Casino (2)

- Pin Up Peru (5)

- pinco (2)

- PinUp apk (31)

- PinUp AZ (3)

- pinup Brazil (3)

- PL vulkan vegas (3)

- post (2)

- Rokubet (2)

- sahabet j oyna (2)

- Senza categoria (2.819)

- sex chat (1)

- Should A Guy Pay On The First Date (1)

- Slot games (1)

- Slot Oyunlari (2)

- Sober living (25)

- Software development (29)

- Sport (1)

- Successful Interracial Marriages (1)

- sugar daddy sites (1)

- Tipobet (1)

- Trading Bot (2)

- Uncategorized (56)

- Uncategorized1 (2)

- UZ Most bet (3)

- vulkan vegas DE (12)

- vulkan vegas DE login (6)

- What Are Russian Women Like (1)

- Who Can Witness A Marriage Certificate (1)

- xCritical.Com – RU (SERM) (1)

- казино (2)

- Комета Казино (1)

- Новини (1)

- Новости Криптовалют (3)

- Онлайн Казино (9)

- Финтех (17)

- Форекс Брокеры (13)

- Форекс Обучение (21)

- Форекс партнерская программа (3)