Managerial Accounting vs Financial Accounting: The Top 10 Differences

Financial accounting requires that financial statements be issued following the end of an accounting period. Managerial accounting may issue reports much more frequently, since the information it provides is of most relevance if managers can see it right away. Financial accounting reports on the profitability (and therefore invoice management guide for beginners and pros alike the efficiency) of a business, whereas managerial accounting reports on specifically what is causing problems and how to fix them. Managerial accounting reports are more likely to be of use in improving operations, while financial accounting reports are used by outsiders to decide whether to invest in or lend to a business.

- In accounting, a conservatism principle is often applied, which suggests that companies should record lower projected values of their assets and higher estimates of their liabilities.

- After the accruals (which affect both the COGS and OPEX accounts), she prepares Primark’s Income Statement for a final review.

- Also, since no external standards are imposed on information provided to internal users, management accounting reports run the risk of being subjective.

- A cash flow statement tracks the actual cash flowing in and out of a company in a given accounting year.

Adhering to Compliance Requirements

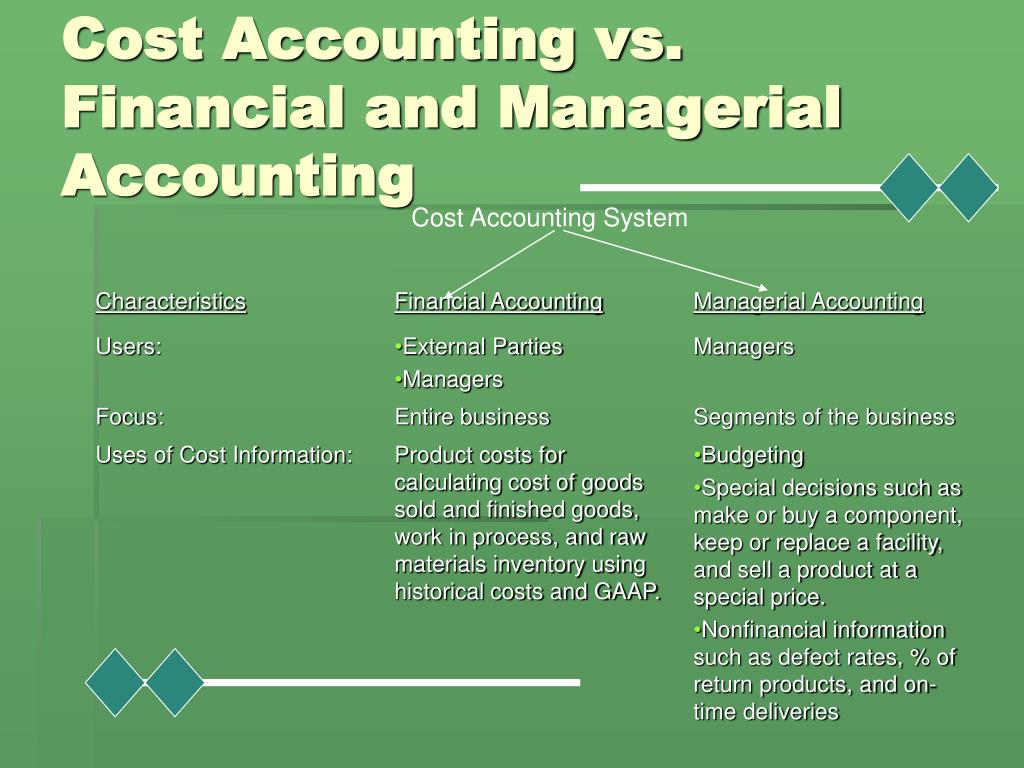

Accounting is crucial in ensuring that a company fulfills its goals and updates strategies to its needs. It includes the standards, conventions and rules that accountants follow in recording and summarizing and in the preparation of financial statements. In the managerial accounting vs. financial accounting decision facing students, one major distinction is the audience for the financial reports each position prepares. The key difference between managerial accounting and financial accounting relates to the intended users of the information.

Difference Between Financial and Management Accounting

The specialized needs of specific users are satisfied through supplementary reports, which are published at various intervals (e.g., annually or quarterly). Managerial accounting statements can be drawn up by Certified Management Accountants (CMAs), while financial accounts are drawn up by Certified Public Accountants (CPAs). We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf.

Reporting Focus

By dividing the business into smaller sections, a company is able to get into the details and analyze the smallest segments of the business. Financial accounting provides information to enable stockholders, creditors, and other stakeholders to make informed decisions. This information can be used to evaluate and make decisions for an individual company or to compare two or more companies. However, the information provided by financial accounting is primarily historical and therefore is not sufficient and is often synthesized too late to be overly useful to management.

Financial Accounting

Moreover, financial statements are released on a regular schedule, establishing consistency of external information flows. Managerial accounting involves identifying, measuring, analyzing, interpreting, and communicating financial information to an organization’s managers for pursuit of that organization’s goals. Unlike accounting’s reliance on transactional data, finance looks at how effectively an organization generates and uses cash through the use of several measurements. The field of finance can be broken down to hone in on the specific types of parties involved, including personal finance, corporate finance, and public finance. While these categories typically include a similar set of activities, each type of finance has nuances that reflect the different regulations, considerations, and concerns of each population. Because it is manager oriented, any study of managerial accounting must be preceded by some understanding of what managers do, the information managers need, and the general business environment.

While the focus of managerial accounting is internal, the focus of financial accounting is external, with a focus on creating accurate financial statements that can be shared outside the company. Managerial accounting typically runs a variety of operational reports throughout the month, while financial accounting runs financial statements at the end of the accounting period. Financial accounting follows generally accepted accounting principles (GAAP), which are a set of accounting standards that are recognized by the accounting profession and regulators.

Companies are often looking for ways to gain a competitive advantage, so they examine a lot of information that might be hard to understand for outside parties. Their deep understanding of company transactions allows them to specialize in financial reporting or managerial reporting. Managerial accounting reports are highly detailed, technical, specific, and even exploratory in nature. Companies are always looking for a competitive advantage, so they may examine a multitude of details that could seem pedantic or confusing to outside parties.

These details are used to prepare financial statements summarizing the financial transactions of a given accounting period. Both financial accounting and managerial accounting provide valuable information for analyzing the performance and profitability of a business. Budgeting, forecasting, and planning are key areas where financial accounting and managerial accounting intersect. Both types of accounting rely on these processes to make informed decisions and manage financial resources effectively.

One key difference between the two is the level of detail provided in operational reports. Managerial accounting provides detailed operational reports that allow managers to analyze the efficiency of different departments and processes within the company. This information can be used to improve profitability by identifying areas where costs can be reduced and revenue can be increased.

Lascia un commento Annulla risposta

Categorie

- ! Без рубрики (335)

- 1 (71)

- 1 win (4)

- 10000_ru (6)

- 10000_tr (9)

- 10000_tr2 (5)

- 10000_wa (5)

- 10020_wa (4)

- 10060_wa (3)

- 10065_wa (3)

- 10080_sat (4)

- 10100_sat (1)

- 10100_tr (4)

- 10120_tr (3)

- 10130_wa (5)

- 10150_sat (3)

- 10150_tr2 (4)

- 10156_wa (2)

- 10170_wa (4)

- 10200_tr (2)

- 10200_wa (7)

- 10205_wa (2)

- 10310_tr (4)

- 10350_tr (2)

- 10350_wa (5)

- 10360_wa (4)

- 10400_sat (3)

- 10400_sat2 (4)

- 10440_tr (5)

- 10450_wa (8)

- 10465_tr (4)

- 10480_tr (6)

- 10490_wa (5)

- 10500_sat (11)

- 10500_sat2 (1)

- 10500_sat3 (3)

- 10500_wa2 (3)

- 10500_wa3 (3)

- 10500_wa4 (2)

- 10520_tr (2)

- 10520_wa (5)

- 10525_sat (4)

- 10550_sat (1)

- 10550_sat2 (3)

- 10550_wa (4)

- 10600_prod (3)

- 10600_prod2 (2)

- 10600_sat2 (1)

- 10600_tr (5)

- 10600_wa (9)

- 10650_wa (4)

- 10650_wa2 (3)

- 10655_pr (1)

- 10700_sat (2)

- 10700_wa (6)

- 10710_wa (4)

- 10750_wa (5)

- 10800_tr (3)

- 10800_wa (1)

- 10830_tr (4)

- 10831_wa (2)

- 10850_sat (1)

- 10900_wa (7)

- 11000_wa (3)

- 11075_tr (5)

- 11275_ru (3)

- 11380_wa (2)

- 11400_wa (3)

- 11800_wa (4)

- 11900_wa (4)

- 15381 (1)

- 1Bet (1)

- 1win (41)

- 1win apostas (1)

- 1Win AZ Casino (2)

- 1win Azerbajany (5)

- 1Win Bénin (1)

- 1Win bet (2)

- 1Win Brasil (6)

- 1win Brazil (5)

- 1win casino (12)

- 1WIN Casino Brasil (1)

- 1win chile (2)

- 1win India (23)

- 1WIN Official In Russia (10)

- 1win Turkiye (7)

- 1win uzbekistan (5)

- 1winRussia (3)

- 1xbet (4)

- 1xbet apk (12)

- 1xbet Argentina (4)

- 1xbet AZ Casino (2)

- 1xbet Azerbajan (3)

- 1xbet Brazil (3)

- 1xbet CASINO AZ (2)

- 1xbet Casino Online (2)

- 1xbet giriş (3)

- 1xbet Online Casino (3)

- 1xbet qeydiyyat (6)

- 1xSlots (14)

- 2 (13)

- 20Bet (1)

- 21 (1)

- 212 (2)

- 22 Bet (1)

- 222 (2)

- 22Bet (1)

- 241536 (1)

- 3 Reyes Casino (1)

- 30 (1)

- 31 (1)

- 32 (1)

- 3650_tr (2)

- 5000_tr (4)

- 5000_tr2 (4)

- 5645 lera (1)

- 5760_ru (3)

- 6570_ru (4)

- 6900_tr (3)

- 7150_tr (3)

- 7240_ru (3)

- 7300_ru (3)

- 7350_ru (3)

- 7375_ru (4)

- 7400_ru (3)

- 7410_ru (2)

- 7430_tr (4)

- 7620_ru (4)

- 777 казино (1)

- 7900_ru (6)

- 7k casino (8)

- 7к казино (3)

- 8000_ru (5)

- 8000_wa (4)

- 8040_ru (4)

- 8100_wa (5)

- 8150_wa (6)

- 8298_prod (1)

- 8300_wa (4)

- 8435_wa (4)

- 8450_ru (3)

- 8470_ru (3)

- 8500_tr (3)

- 8590_tr (4)

- 8600_ru (6)

- 8600_tr (1)

- 8600_tr2 (2)

- 8670_ru (3)

- 8700_wa (1)

- 8746_wa (5)

- 8800_ru (3)

- 888888 (1)

- 888starz (1)

- 888starz Casino (2)

- 8900_ru (4)

- 8900_ru2 (2)

- 8900_tr (3)

- 8930_ru (2)

- 8990_wa (4)

- 9000_wa (4)

- 9000_wa2 (4)

- 9020_wa (4)

- 9050_tr (1)

- 9065_tr (4)

- 9080_ru (2)

- 9090_wa (4)

- 9100_wa (12)

- 9150_wa (4)

- 9150-2_ru (3)

- 9185_ru (7)

- 9200_ru (11)

- 9200_ru2 (6)

- 9200_wa (4)

- 9270_ru (3)

- 9300_ru (3)

- 9300_wa (10)

- 9330_ru (3)

- 9350_wa (3)

- 9380_wa (4)

- 9400_ru (9)

- 9400_wa (4)

- 9460_ru (6)

- 9500_2ru (8)

- 9500_3ru (8)

- 9500_wa (5)

- 9500_wa2 (3)

- 9560_ru (6)

- 9590_wa (5)

- 9600_wa (3)

- 9617_tr (3)

- 9620_ru (8)

- 9650_wa (3)

- 9655_wa (4)

- 9670_wa (4)

- 9700_wa (3)

- 9750_ru (6)

- 9750_wa (1)

- 9760_wa (6)

- 9780_wa (4)

- 9800_wa (8)

- 9820_ru (8)

- 9820_wa (4)

- 9860_wa (4)

- 9890_wa (2)

- 9900_wa (7)

- 9915_wa (4)

- 9925_wa (5)

- 9950_tr (2)

- 9950_wa (3)

- 9990_tr (2)

- AI News (12)

- Architecture (1)

- Arkada Casino (3)

- article (3)

- articles (1)

- Artifical Intelligence (1)

- Artificial Intelligence (1)

- Artificial intelligence (AI) (2)

- Asia99 (2)

- au (1)

- Audiobooks24 (3)

- Aviator (1)

- AZ Most BET (1)

- Azerbajany Mostbet (3)

- Azur Casino (1)

- b1bet apostas (3)

- Baccarat Online (1)

- Bahisyasal (7)

- Bahsegel (3)

- Bankobet (1)

- Basaribet (3)

- BC Game (1)

- Best Australian Online Casinos and Pokies (1)

- Best Australian Online Casinos and Pokies with PayID in 2025 (1)

- Best Nationality Man To Datehttps://3.bp.blogspot.com/-kBknlnppsDo/VogAaAUQObI/AAAAAAAAGIQ/GwgzMkHTbi4/s400/beautiful-bbw-13_mini.jpg|loving someone long distance (1)

- Best Online Casino (4)

- Best Online Sportsbooks (1)

- Best Replica Rolex Watches (1)

- Best Slot Sites (1)

- best-polskie-kasyno (1)

- Beste Sites (4)

- Bet22 Casino (1)

- betjam casino (1)

- Betmotion brazil (1)

- Bettilt (3)

- Bettilt giris (2)

- Betting (4)

- Betting Brokers (6)

- Betway (1)

- betwinner-th.com (1)

- betwinnertr-giris.com (1)

- BH (7)

- bh50 bahis forum (2)

- bht2 (3)

- bitcoin plinko (1)

- bitcoin roulette (1)

- Blog (10)

- bloggs (1)

- blogs (2)

- bonanza dec (3)

- Bookkeeping (86)

- Bootcamp de programação (2)

- Bootcamp de Programación (3)

- boutiq switch disposable (2)

- brawl pirates 1win (1)

- Bruno Casino (1)

- BT (2)

- bt50 flaming hot slot (4)

- btt2 (2)

- Casino (83)

- Casino 1Win (1)

- Casino 1xSlots (1)

- Casino 365 (1)

- casino 7k (2)

- casino en ligne (4)

- casino en ligne fr (3)

- casino en línea (7)

- casino onlina ca (6)

- Casino Online (56)

- casino online 1win (2)

- casino online ar (19)

- CASINO ONLINE CZ (2)

- casinò online it (10)

- Casino Sans Wager (1)

- Casino Slots (2)

- casinomaxisites oyna (3)

- casinos (2)

- Casinos Online (4)

- casinos-nongamstop.uk19 (1)

- cassino online (3)

- česká online casina (1)

- Česká online kasina (2)

- CheckBasinas (1)

- chicken road CA (1)

- chicken road UK (1)

- Christchurch Online Casino (1)

- Codere AR (3)

- codere mexico (3)

- Crown Pokies online (2)

- Crypto Bot (1)

- crypto crash game (1)

- crypto wallet (6)

- Crypto-PBN (3)

- Cryptocurrency exchange (5)

- Cryptocurrency investments (1)

- Cryptocurrency News (6)

- Cryptocurrency service (13)

- data macau (2)

- Dating A Foreigner (1)

- Dating Someone From A Different Country (2)

- Deployment (2)

- Diplom-1 (1)

- Diplom-4 (1)

- Diploms (2)

- DKC Transport (1)

- done 15381 (2)

- Dragon казино (1)

- DragonMoney (3)

- e-Kitap Depolama (3)

- EASY MOVING (2)

- Education (5)

- En (1)

- Fall In Love With Someone You Don't Share A Common Language (1)

- Financial Marketplace in the USA (2)

- FinTech (38)

- Forex ENG (2)

- Forex Trading (1)

- Forex Trading (39)

- Fortune Mouse (1)

- Fortune Tiger (4)

- fr (2)

- Free Porn Videos (1)

- Fundalor Casino (2)

- Fusion (1)

- fxdu.net (1)

- g (1)

- Gambling (13)

- Gaming (1)

- Generative AI (3)

- ghostwriter (1)

- hd porn (1)

- hello world (1)

- Hitbet (1)

- Honey money казино (1)

- How Can I Date A Girl From A Different Country (1)

- How To Date Someone Internationally (1)

- Hype casino (2)

- iGaming (18)

- India Mostbet (5)

- Indian generic price (2)

- Infrastructure (1)

- Instances (1)

- Investimentos em criptomoedas (1)

- Investissements en cryptomonnaie (1)

- IT Education (5)

- IT Support Orange County (1)

- IT Vacancies (3)

- IT Вакансії (8)

- IT Образование (21)

- IT Освіта (1)

- IviBet (1)

- JeetCity Casino (1)

- Juegos de casino en línea en Sudamérica (1)

- Kasyno Online (18)

- Kasyno Online PL (4)

- Kazino (18)

- king johnnie (5)

- kupit diplom (1)

- Ledger (1)

- ledger live (10)

- legit mail order brides (2)

- leovegas finland (3)

- LeoVegas India (7)

- LeoVegas Sweden (6)

- Lex Casino (2)

- LinkedIn Scraper (1)

- Logging (1)

- Lucky Green casino (2)

- lucky jet (7)

- Managed IT Services Orange County (1)

- Marriage Certificate Requirements (1)

- marsbahis (1)

- Masalbet (1)

- MaxiMarkets (1)

- Meilleur casino en ligne (1)

- Melhores Cassinos Online (1)

- More Magic Apple (1)

- most bet (1)

- Most Romantic Honeymoon Destinations (1)

- Mostbet (15)

- mostbet apk (22)

- Mostbet AZ (4)

- mostbet az 90 (19)

- Mostbet AZ Casino (3)

- mostbet azerbaijan (5)

- Mostbet Casino Azerbaycan (1)

- mostbet casino online (1)

- Mostbet Casino UZ Online (1)

- mostbet giriş (9)

- Mostbet India (4)

- mostbet kirish (2)

- Mostbet Online (1)

- mostbet oyna (3)

- mostbet ozbekistonda (5)

- mostbet royxatga olish (2)

- Mostbet Russia (11)

- mostbet tr (1)

- mostbet UZ (12)

- Mostbet UZ Casino (2)

- Mostbet UZ Casino Online (2)

- Mostbet UZ Kirish (1)

- Mostbet Uzbekistan (3)

- mostbet-ru-serg (8)

- MrBeast (1)

- MrBeast Casino (1)

- Mystake Casino (1)

- n_bh (5)

- n_by (1)

- n_ch (2)

- n_pb (1)

- n_pu (2)

- n_rb (1)

- N1 Casino (1)

- Najlepsze zakłady (2)

- New Blog (1)

- New folder (2) (1)

- New Post (6)

- News (291)

- Nine Casino (1)

- Nutrition (1)

- Old Links (1)

- Online Betting (1)

- online blackjack australia (2)

- Online casino (214)

- online casino au (4)

- Online Dating Europe (1)

- Online games (2)

- Online Kasyno (2)

- onwin dec (1)

- onwin oyna (1)

- Padişahbet (1)

- pagbet brazil (1)

- Paribahis (3)

- Pariuri Sportive (3)

- PB (3)

- pb50 roll oyna (2)

- pbt2 (4)

- PDF eBooks Kulübü (2)

- Pin UP AZ Casino (1)

- Pin UP AZ Online (1)

- Pin Up Brazil (3)

- pin up casino (4)

- Pin UP Casino AZ (3)

- Pin UP Online Casino (3)

- Pin Up Peru (5)

- pinco (5)

- Pinco Online Casino (2)

- PinUp (1)

- PinUp apk (33)

- PinUp AZ (3)

- pinup Brazil (3)

- PL vulkan vegas (3)

- plinko (19)

- Plinko Casino (1)

- Pocket (1)

- porn (1)

- post (2)

- Pozyczki (2)

- Prod (2)

- Quotex (2)

- Ramenbet (1)

- raularagon.com.ar (1)

- RB (1)

- Replica Rolex (4)

- ricky casino australia (64)

- Rituals (1)

- RocketPlay Casino (5)

- Rokubet (4)

- Rolex replica (3)

- Royal Reels (3)

- Royal Reels 7 (3)

- Royal Reels Casino (5)

- RoyalReels7 (2)

- sahabet j oyna (2)

- Security (1)

- Senza categoria (5.262)

- seo (1)

- sex chat (1)

- Should A Guy Pay On The First Date (2)

- Sky Crown Online Casino (1)

- SkyCrown Casino (3)

- Slot games (1)

- Slot Oyunlari (2)

- slot-play (1)

- Sober living (57)

- Software development (1)

- Software development (45)

- Space Fortuna (1)

- Spinado Casino (1)

- Sport (1)

- Sports Betting Odds (8)

- Stake Casino (1)

- StarzBet Casino (2)

- Successful Interracial Marriages (2)

- sugar daddy sites (2)

- sweet bonanza TR (11)

- T-Exchange (2)

- te (1)

- Tech (1)

- Terrenos en Mérida Yucatán en Venta (1)

- The Real World by Andrew Tate (1)

- Tipobet (1)

- Top Managed IT Services (5)

- Top Online Casinos (2)

- Trading Bot (2)

- Trezor (2)

- Uncategorized (64)

- Uncategorized1 (2)

- Unique Casino (1)

- Unlim Casino (2)

- UZ Most bet (4)

- Vamos Bet (2)

- verde casino hungary (1)

- Vovan Casino (1)

- vulkan vegas DE (12)

- vulkan vegas DE login (6)

- Wellness (1)

- What Are Russian Women Like (1)

- Who Can Witness A Marriage Certificate (1)

- Womux Чехлы (2)

- xCritical.Com – RU (SERM) (1)

- Аркада Казино (3)

- Без категории (1)

- Биржа EXMO (2)

- водка казино (3)

- Горила Казино (1)

- займы онлайн (2)

- казино (12)

- Казино онлайн (6)

- Комета Казино (5)

- Криптобосс казино (1)

- купить крауд ссылки (6)

- Лекс Казино (2)

- Лучшие Казино Без Верификации и Регистрации (1)

- Лучшие казино на деньги без паспорта и верификации (1)

- Лучшие казино онлайн (4)

- Микрокредит (18)

- Новини (1)

- Новости Криптовалют (5)

- Онлайн Казино (22)

- Пластиковые окна (1)

- Пластиковые окна в Москве (2)

- Рейтинг Казино (2)

- Ставки на спорт (10)

- Таро онлайн (2)

- тест без проксі (1)

- Финтех (26)

- Форекс Брокеры (22)

- Форекс Обучение (27)

- Форекс партнерская программа (3)

- Чемпион Казино (2)