If necessary, you may include additional categories that are relevant to your business. Suppose our business has two divisions, the semiconductor division and the mobile division, and wants to be able to identify its expenses between the two. All other account types (assets, liabilities, equity, and revenue) are not separated and are to be recorded in a default code referred to as the Head Office division. The two digit division codes allocated are Semiconductor Division 03, and Mobile Division 04 with the default division for all other entries being the Head Office Division 00. The 5 digit chart of accounts numbering system allows for up to 100 departments (0-99) each with 1,000 accounts. Of course it is not necessary to divide every account into 100 departments.

The four main account types in a chart of accounts list

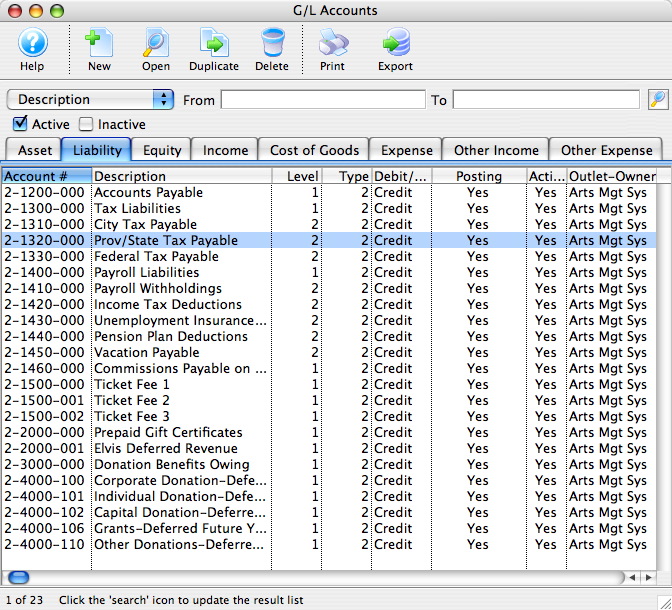

Understanding the fundamentals of COA can revolutionize how you manage business finances, leading to improved financial decisions and strategic planning. Your long-term liabilities, which include debts like mortgages and bonds, are listed after your more current liabilities. Your accounting software should come with a standard COA, but it’s up to you and your bookkeeper or accountant to keep it organized. Here are tips for how to do this, plus details about what a COA is, examples of a COA and more.

Identify Primary Account Categories

A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance. Looking at the COA will help you determine whether all aspects of your business are as effective as they could be.

Is There a Single COA Format?

Revenue is the amount of money your business brings in by selling its products or services to clients. This would include your accounts payable, any taxes you owe the government, or loans you have to repay. Depending on your business size and needs, such as when subscribing to a business premium accounting service, you can adjust the ranges. The aim is to keep things intuitive for anyone taking a peek into your financials. These numbers are typically four digits, and each account has a unique number.

- Each department now has its own account and the total of the three accounts will represent the total wages expense.

- Start with broad categories and drill down into specific accounts, leaving room for growth and ensuring clarity for financial reporting and analysis.

- These categories typically include assets, liabilities, shareholder’s equity for the balance sheet, and revenue and expenses for the income statement.

- Unlike balance sheet accounts, income statement accounts close at the end of each accounting period.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- A chart of accounts is a comprehensive, organized list of all the financial accounts a company uses to record its financial transactions.

Equity accounts are a crucial component of a company’s chart of accounts as they represent the owners’ interest in the assets of the business. These accounts track the shareholders’ investment in the company and the share of ownership for each individual investor. Some of the primary equity account entities include common stock, preferred stock, shareholders’ equity, and retained earnings. This section elaborates on the shareholders’ equity and retained earnings subsections.

In addition, the operating revenues and operating expenses accounts might be further organized by business function and/or by company divisions. Say you have a checking account, a savings account, and a certificate of deposit (CD) at the same bank. When you log in to your account online, you’ll typically go to an overview page that shows the balance in each account. Similarly, if you use an online program that helps you manage all your accounts in one place, like Mint or Personal Capital, you’re looking at basically the same thing as a company’s COA. Each account in the chart of accounts is typically assigned a name and a unique number by which it can be identified.

Account categories include assets, liabilities, equity, revenue, and expenses. FreshBooks will help you stay organized with a user-friendly interface that keeps things simple. A chart of accounts is a small business accounting tool that organizes the essential accounts that comprise your business’s financial statements.

They represent long-term debts or obligations that will be settled over an extended period. Noncurrent liabilities indicate your long-term financial commitments and your company’s ability to manage its debt over time. Yes, it is a good idea to customize your chart of accounts to suit your unique business. Business owners who keep a chart of accounts handy will have an advantage when it comes to accounting. An added bonus of having a properly organized chart of accounts is that it simplifies tax season.

Your chart of accounts is a living document for your business, meaning, over time, accounts will inevitably need to be added or removed. The general rule for adding or removing accounts is to add accounts as they come in, but wait until the end of the year or quarter to remove any old pacesetter novels accounts. But the final structure and look will depend on the type of business and its size. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

The COA tracks your business income and expenses, which you’ll need to report on your income tax return every year. You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can use to record transactions, make reports, and prepare financial statements throughout the year. The relationship between journal entries and the chart of accounts is akin to the relationship between a script and its cast of characters. The COA serves as the cast—a structured list of all accounts where financial transactions can be recorded. Journal entries, on the other hand, are the script— the actual recording of financial transactions as they occur. Unique numbers assigned to accounts enable easy identification and classification.

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. In this case the department code remains fixed at 01 (production department) and the division code changes to either 03, 04, or 00. The division code remains fixed at 04 (mobile division) whereas the department code changes to either 01, 02, or 00. As I close, let me encourage you to give your chart of account decisions plenty of thought. If you don’t give your chart of accounts the early love it deserves, you may regret it. Creating a new accounting systems six years out, for example, would be a major headache.